The Pittsburgh Public Schools board will have to meet later this month to determine how it will fund a budget it approved Wednesday night.

During a more than two-hour meeting, the board approved a $665.6 million budget, in a 5-4 vote. That budget included funding from a proposed 2.3 percent property tax increase. But in a separate vote, the property tax increase failed 4-4.

Veronica Edwards, Pam Harbin, Devon Taliaferro, and Sylvia Wilson approved the budget and the tax increase. Kevin Carter approved the budget, but abstained from the tax increase vote. Cindy Falls, Bill Gallagher, Terry Kennedy, and Sala Udin voted against both measures.

Solicitor Ira Weiss said it was an unusual move that he hadn’t seen in his more than 40 years working with school districts. He said that the board would have to figure out how it will levy property taxes that fund the budget it approved before the end of the year or it won’t be able to pay its bills.

The board agreed to continue the meeting Dec. 27 at noon at the administrative offices in Oakland to vote on the district's property tax millage rate.

After the meeting, Carter said he was sure that the board would find a solution. He said he abstained from the property tax vote because he promised his constituents he wouldn’t raise taxes.

That increase, if passed, would amount to another $23 for a property valued at $100,000. City residents also pay property taxes to the City of Pittsburgh and Allegheny County. While suburban property taxes vary, Pittsburgh Public Schools still has the lowest school property tax rate in the county.

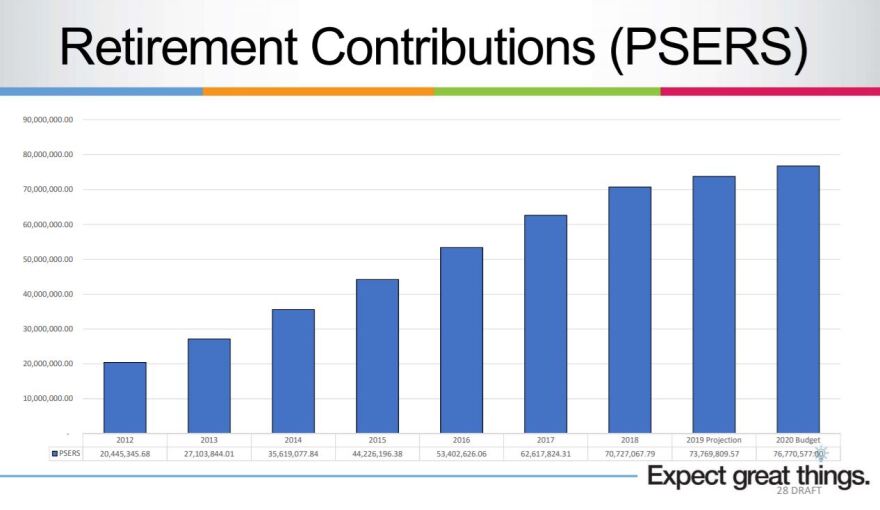

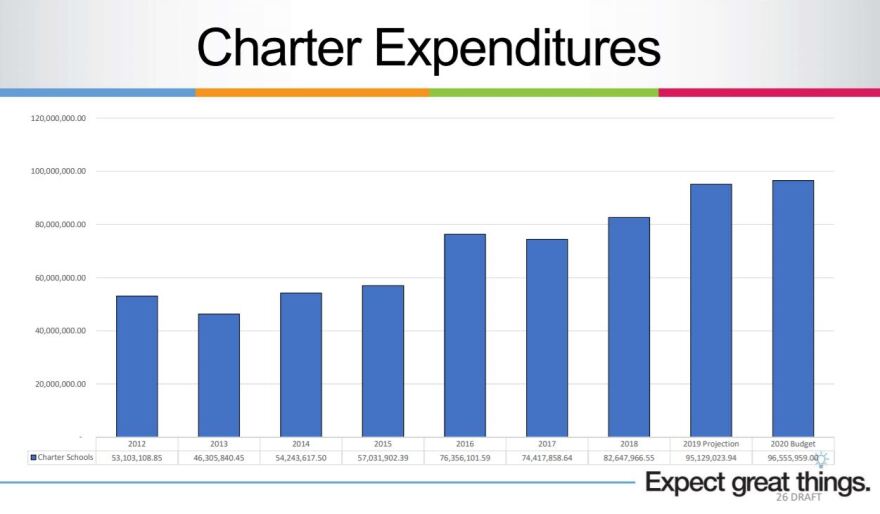

The district faces a $27.3 million operating deficit. Leaders say costs outside of the district’s control are growing at a faster rate than its revenue. They say additional funding is needed to make up for spending more on retirement costs and charter school payments – together those items account for 28 percent of the budget.

The tax increase would amount to nearly $4 million, less than 1 percent of the district’s now $665.6 million budget.

Udin said district leaders haven’t justified the need for more funding as enrollment has dropped in the past few years as the budget grows. He said the district also hadn’t guaranteed him that the money would be used to improve student achievement.

Falls and Kennedy both raised concerns about the financial impact a tax increase would have on those with fixed incomes.

Harbin said she understood that concern, but that “taking away money from [kids] is counter-intuitive.”

“We’re trying to maintain what we have because expenses have outpaced revenues and the only revenue we have as a taxing body is this tax,” she said.

Taliaferro said she didn’t make her decision lightly and that there is still hard work to be done.

“It starts today. I’m happy to support something that will get us to where we need to be,” she said.

Carter said that the budget is larger because of growing costs outside of the district’s control.

“It is not because of the travel budget, it is not because of irresponsible spending … these are not the issues. The issues we’re dealing with impact real people and real children in classrooms,” he said.

Community members who spoke at a public hearing before the board Monday said they supported an increase if it meant the district didn’t have to make drastic cuts.

PPS chief financial officer Ron Joseph said that the district won’t be able to tax its way out of its financial situation.

“We do realize that this tax increase will not fully solve the problem and there will need to be more work in the administration … to try to find ways to identify alternative sources of revenue,” he said.

Kennedy proposed amending the budget and eliminating the tax increase. Her proposal to cut the budget by 5 percent would have amounted to about $33 million. Hamlet said that cut would mean looking at the largest portion of the district’s budget – jobs.

That amendment was voted down with only Kennedy voting ‘yes’.

One of the changes the district has floated is putting an end to a diversion of the city’s earned income tax. A larger portion of that tax became the City of Pittsburgh’s more than 15 years ago when the city was on the verge of financial collapse.

At a budget presentation meeting in early November, Superintendent Hamlet said that money would help the district. His administration estimates that diverted tax would bring in another $18 million for the city school district.Pittsburgh Mayor Bill Peduto then said that he would fight that move.

The two leaders met earlier this week. Peduto told the Post-Gazette that the meeting was an opportunity to clear the air. He has opposed the tax increase but said he’d work with the district to find alternative funding sources. Hamlet did not speak with reporters after the meeting.

Gallagher said he thought the district faced a "trust issue" with the community and that the proposed increase should have come in a few months after thedistrict takes on it's project to "re-imagine PPS".