SCOTT SIMON, HOST:

General Electric is an American success story and now maybe a cautionary tale. Fueled by some of the greatest inventions of the industrial age, GE became the country's most valuable company on the stock market and the force behind a memorable jingle.

(SOUNDBITE OF AD)

UNIDENTIFIED SINGERS: (Singing) You bring good things to life.

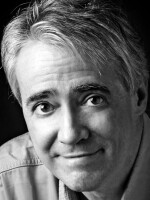

SIMON: Then a series of missteps damaged its reputation and stock price. The conglomerate was broken up into separate parts. And that process ended this week when GE Vernova, an energy company, spun off from GE Aerospace. William Cohan is an investment banker turned journalist and author of "Power Failure: The Rise And Fall Of An American Icon." He joins us now. Mr. Cohan, thanks so much for being with us.

WILLIAM COHAN: Thank you for having me, Scott.

SIMON: What did GE represent, do you think, in American history?

COHAN: Well, it represented the zenith of American corporate power, industrial might, innovation. I mean, it was everything. It was sort of like the Google and the Microsoft and the Netflix and the Apple rolled into one in the 20th century.

SIMON: Light bulbs, first X-ray machine, first jet engine.

COHAN: First electric cars, first MRI machines.

SIMON: Let me ask you about the role that Jack Welch came to play. He became GE's leader in 1981. Certainly, for much of that time, considered the top CEO in the country. Why?

COHAN: Well, when he took over GE, you know, market value in the stock market was 12 billion. And at one point shortly before he left, it was worth 650 billion. So Jack basically had the media and had the Wall Street analysts eating out of the palm of his hand. They loved him.

SIMON: Let me ask you about another aspect of Jack Welch's rule. He became known as Neutron Jack for laying off what he considered the bottom 10% of employees every year. Here's a clip of him eight years ago at the President's Summit in Copenhagen.

(SOUNDBITE OF ARCHIVED RECORDING)

JACK WELCH: You have to call people then, like I did in the early '80s, and say to them, I'm sorry, Mary. You have to go. And Mary says to you, why me? And you have to say to her, you're the worst person that we have here. And she says to you, but I've been here 31 years. Why didn't anybody ever tell me? And people say, I'm too kind to give an honest appraisal. Kind? That's cowardly.

SIMON: I met Jack Welch a couple of times when I worked at NBC. Nice to me, but that's quite a cold streak.

COHAN: Yeah, that's a little harsh. I think we can all agree on that. But layoffs happen every day across corporate America. Jack just gave a name to what pretty much everybody else was doing anyway, and it's just part of capitalism.

SIMON: You worked for GE Capital for a short time - right? - back in the '80s?

COHAN: Yes. For two years after I got my MBA at Columbia, I worked financing leveraged buyouts, of all things.

SIMON: Well, what was that like to be there?

COHAN: I mean, when I was there, it was the late '80s. GE capital was a powerhouse.

SIMON: With the advantage of hindsight, did it make the whole company, though, more valuable when the economy turned?

COHAN: Well, I mean, obviously, banking is extremely risky. GE Capital and GE almost went down the tubes, too. And Jeff Immelt had to go hat in hand to Hank Paulson and Sheila Bair, who was head of the FDIC, for a bailout. And that started a whole series of events that led to the sale of NBC Universal and the dissolution of GE Capital and the promise of earnings that could not be replaced and the loss of confidence from investors who had supported the company for decades. So in the end, what really got GE to be now three separate companies and split up and not the great, admired company it used to be was the 2008 financial crisis.

SIMON: Did GE diversify too much?

COHAN: I think it relied too heavily on GE Capital. And then, you know, after the financial crisis, Jeff Immelt tried to diversify away from financial services by buying this power business of this French company called Alstom. But he really paid too much for it, and it didn't produce the kind of earnings that he thought it would. And after he sold off GE Capital, they didn't have the earnings that they had promised Wall Street, and that became sort of a death knell.

SIMON: William Cohan is the author of "Power Failure: The Rise And Fall Of An American Icon." Thanks so much for being with us.

COHAN: Thank you, Scott.

(SOUNDBITE OF EZRA COLLECTIVE'S "EGO KILLAH") Transcript provided by NPR, Copyright NPR.

NPR transcripts are created on a rush deadline by an NPR contractor. This text may not be in its final form and may be updated or revised in the future. Accuracy and availability may vary. The authoritative record of NPR’s programming is the audio record.